Economic Landscape & Market Recovery

Given the current economic landscape, how do you assess the state of the real estate market today—and when do you expect to see a meaningful recovery?

The past two and a half years have been challenging for real estate. We’ve had to battle one of the fastest and steepest interest rate hikes in history, along with a flood of new supply that began during the low-rate environment, which has pressured rental growth and valuations.

We’re now starting to see the foundation of a recovery take shape. One of the most important shifts is the sharp drop in new supply—happening just as supply chains are being disrupted and input costs are rising due to the uncertain tariff policy. This means we’re going to see less supply for longer, and in many cases, assets trading below replacement cost.

We also believe interest rates are coming down. In Europe, inflation peaked at 10% and rates rose to 4%. Today, inflation sits at 1.9% and rates are 2%. In the U.S., inflation peaked at 9% and today sits at 2.5%, but rates have only fallen to 4.25%. The Fed is behind. Interestingly, despite the supply headwinds, occupancies, particularly in multifamily, have remained in the mid-90s%. Households can’t afford to buy homes, so they’re renting. Meanwhile, incomes have risen, which has improved rent affordability.

The recovery won’t be a straight line, but we do expect a more constructive environment in 2026, especially if the Fed starts cutting rates as many expect. Lower rates would bring capital back into the market. That said, even in today’s environment, there’s opportunity. The key is staying disciplined—owning the right sectors in the right markets. That’s exactly how we’ve positioned Starwood Real Estate Income Trust (“SREIT”).

Key Updates on SREIT

SREIT, one of Starwood Capital’s largest real estate investment vehicles, recently provided an update to stockholders. What were some of the takeaways?

The main message I wanted to deliver is simple: SREIT’s portfolio is in excellent shape. We’ve built a $23 billion portfolio focused on high-quality, stabilized, income-producing real estate. SREIT is 94% occupied, 56% levered, and nearly 90% of our assets are in sectors with strong long-term fundamentals—rental housing, industrial, and real estate loans. About 80% of the portfolio sits in high-growth Sunbelt markets, where job growth, population migration, and affordability trends are all working in our favor over the long-term.

That positioning has translated into strong underlying fundamentals. Over the past two years, SREIT delivered a compounded 12% increase in same-store net operating income—outpacing our peer set and demonstrating the strength of the portfolio we’ve built.

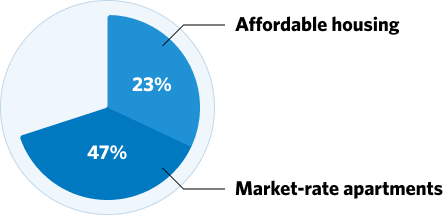

Looking ahead, what really sets us apart is our 70% concentration in two sectors: affordable housing and market-rate apartments. Affordable housing is 23% of the portfolio and, frankly, is the crown jewel of our strategy. It’s income-linked, pretty much always occupied, undersupplied, and rents can’t go down. For our portfolio, HUD recently approved nearly 7% rent increases, with an additional 2% deferred into 2026, giving us predictable income growth. Half of our portfolio is market rate. Rents are around half the cost of owning a home, and with construction starts down significantly, we see real tailwinds ahead.

SREIT Performance

How has SREIT performed?

There’s been some noise in the media, some of it misleading, so let’s set the record straight. Since the start of 2024, SREIT’s total return has been roughly flat, which, given broader market volatility, we believe is a solid outcome and in line with expectations. Our current annualized distribution rate is 5.9%, or close to 10% on a tax-equivalent basis for investors in the top tax bracket. That’s attractive income, and if short-term rates move lower, as the forward curve suggests, that distribution only becomes more compelling.

SREIT’s performance really comes down to two key factors: the quality of our real estate and our interest rate hedges. And the real estate, which is what matters most over the long-term, has held up well. It was up 2.2% in 2024 and is up 0.3% through May of 2025, supported by modest rent growth.

Our nominal NAV has come down but mainly because we have returned over $5 billion to investors through share repurchases. Investors have not lost 40% of their capital as the Wall Street Journal implied. Since inception, our Class I shares have delivered an annualized total return of 6.2%. Bottom line: SREIT is doing what we built it to do—generate stable, tax-efficient income and deliver long-term value to our investors.

Why Non-Traded REITs Matter

There has been a lot of discussion around non-listed REITs in recent years. Why do you believe these vehicles are both necessary and attractive?

Non-listed REITs fill an important gap in the investment landscape. They give individual investors access to high-quality real estate, the kind institutions have owned for decades, without the daily volatility of the stock market. That’s a big deal, especially in a world where people are looking for stable income and diversification. And with vehicles like SREIT, that income is often tax-advantaged, which makes it even more attractive.

income

The data speaks for itself: nearly 75% of our investors have never submitted a redemption request. They’re staying in, collecting attractive income, and seeing the benefit of having a real asset-backed strategy in their portfolios. Yes, capital raising is slower across all of equity real estate right now. That’s to be expected in this environment of muted performance. But real estate is the world’s largest asset class, the U.S. enjoys population growth and a broad buoyant economy, and real estate will turn a corner. We believe there’s a long future ahead for non-traded REITs, especially for investors who understand the asset class and are in it for the long haul.

Liquidity Strategy & Asset Sales

Could you provide an update on SREIT’s liquidity strategy, and what factors influenced your recent asset sale decisions?

In May 2024, we made the deliberate decision to pause property sales and amend our share repurchase plan. That wasn’t easy, but selling assets into what we believed was the bottom of the market didn’t make sense. Our job is to protect long-term value for all investors. That patience paid off. After the Fed cut rates in September, capital markets improved, and we were able to execute $1.6 billion in asset sales—at prices within 1% of our valuations and at cap rates that are 75 – 100 bps better than what the market was seeing just a few months earlier. By waiting for the right window, we believe we generated 15–20% more value on those sales. In addition, we focused on keeping the assets we thought would perform the best over the long term in the portfolio. With that progress, we recently announced several enhancements to our share repurchase plan. We have increased our monthly share repurchase limit from 0.33% to 0.50% of NAV, and the quarterly limit from 1.00% to 1.50%. We also added some practical improvements to ease pressure points in the redemption process, such as raising the minimum account balance which allows smaller accounts to be fully redeemed sooner.

Share Repurchase Plan

How do you respond to concerns from SREIT stockholders who are seeking to redeem their investments?

We hear the concerns, and we don’t take them lightly. We are aligned with our shareholders. Our management fees are paid in stock and Starwood Capital Group owns almost 5% of the NAV. This has been a challenging market, and I fully understand the frustration from investors who want access to their capital. Since we put tighter liquidity limits in place in May 2024, stockholders requesting redemptions have still received 40% of their capital back. But we understand it’s a cumbersome process, and we remain committed to pursuing a long-term liquidity solution for SREIT. In the meantime, we’re aligning ourselves with investors by continuing to waive 20% of our management fee—bringing it down from 1.25% to 1.00% of NAV—until we can fully reinstate the standard liquidity levels. Our job is to operate with a fiduciary mindset, be disciplined, and protect long-term value—even when it’s uncomfortable. And that’s what we’re committed to doing.

Starwood's Platform Advantage

How does Starwood’s broader platform and experience give SREIT a competitive advantage in today’s market?

We believe our 33-year history and our platform is a real edge. Starwood is the nation’s largest owner of affordable housing and one of the largest owners of market rate apartments as well. We have navigated six business cycles successfully and moved in and out of sectors as conditions changed. We own or finance over $300 billion of real estate, giving us real-time insights into everything from the latest prices, leasing, and market performance to financing terms. And everyone at Starwood makes it their primary objective to share these insights across the firm so we make the most well-informed decisions. This scale gives us access to data, relationships, and opportunities that others just don’t have.

For SREIT, it means we’ve hand-picked a portfolio that reflects long-term demand trends and is backed by a platform that combines research, local knowledge, and operating experience. In a market like this, where timing and discipline are everything, that platform is a significant advantage.

Past performance does not guarantee future results. Financial data is estimated and unaudited. All figures as of May 31, 2025 unless otherwise noted. Opinions expressed reflect the current opinions of SREIT as of the date appearing in the materials only and are based on SREIT’s opinions of the current market environment, which is subject to change. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

Starwood Proprietary Data. Certain information and data provided herein is based on Starwood REIT Advisor, L.L.C.’s (“Starwood”) proprietary knowledge and data. Portfolio companies may provide proprietary market data to Starwood, including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures and valuations for multiple assets. Such proprietary market data is used by Starwood to evaluate market trends as well as to underwrite potential and existing investments. While Starwood currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Starwood’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof.

Third Party Information. Certain information contained in this material has been obtained from sources outside Starwood, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Starwood, SREIT, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Forward-Looking Statement Disclosure. This material contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will, “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, repurchases, acquisitions, future performance and statements regarding identified but not yet closed acquisitions. Such forward looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in SREIT’s annual report for the most recent fiscal year, and any such updated factors included in SREIT’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or SREIT’s public filings). Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

An investment in Starwood Real Estate Income Trust, Inc. involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should carefully read the information set forth in the “Risk Factors” section of the prospectus before buying our shares. Terms used and not defined herein have the same meanings set forth in the prospectus. Risks include, but are not limited to:

- We have incurred GAAP net losses attributable to stockholders and an accumulated deficit in the past and may incur GAAP net losses attributable to stockholders and continue to have an accumulated deficit in the future.

- We have held certain of our current investments for only a limited period of time, and investors will not have the opportunity to evaluate our future investments before we make them.

- Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, repurchases are subject to available liquidity and other significant restrictions, including monthly and quarterly repurchase limits. Since October 2022, repurchase requests have consistently exceeded the applicable monthly and/or quarterly limits of our share repurchase plan and may continue to do so in the future. Further, our board of directors may modify or suspend our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.

- We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings or offering proceeds (including from sales of our common stock or Operating Partnership units to the Special Limited Partner), and we have no limits on the amounts we may pay from such sources.

- The purchase and repurchase price for shares of our common stock are generally based on our prior month’s NAV (subject to material changes as described in the prospectus) and are not based on any public trading market. While there are independent annual appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day.

- We are dependent on Starwood Capital and its affiliates, including Starwood REIT Advisors, L.L.C. (the “Advisor”), and their key personnel who provide services to us through the Advisory Agreement, and we may not find a suitable replacement for the Advisor if the Advisory Agreement is terminated, or for these key personnel if they leave Starwood Capital or otherwise become unavailable to us.

- This is a “best efforts” offering. If we are not able to continue to raise a substantial amount of capital on an ongoing basis, our ability to achieve our investment objectives could be adversely affected.

- There are limits on the ownership and transferability of our shares.

- If we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease.

- The acquisition of properties may be financed in substantial part by debt. The use of leverage involves a high degree of financial risk and will increase the exposure of the investments to adverse economic factors.

- Investing in commercial real estate assets involves certain risks, including, but not limited to: changes in values caused by global, national, regional or local economic, demographic or capital market conditions, including economic impacts resulting from trade conflict, civil unrest, national and international security events, geopolitical events, military conflicts and war, the performance of the real estate sector, unemployment, stock market volatility, adverse economic conditions as a result of an epidemic, pandemic or other health-related issues; demographic or capital market conditions; operational risks such as cyberattacks; increases in interest rates and lack of availability of financing; changes in government rules, regulations and fiscal policies; vacancies, fluctuations in the average occupancy and room rates for hospitality properties; and bankruptcies, financial difficulties or lease defaults by our tenants.

- A change in U.S. tax laws could adversely impact benefits of investing in our shares.

This sales and advertising literature does not constitute an offer to sell nor a solicitation of an offer to buy or sell securities. An offering is made only by the prospectus. This material must be read in conjunction with the Starwood Real Estate Income Trust, Inc. prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy of the prospectus must be made available to you in connection with any offering. No offering is made except by a prospectus filed with the Department of Law of the State of New York. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of these securities or determined if the prospectus is truthful or complete, or determined whether the offering can be sold to any or all purchasers in compliance with existing or future suitability or conduct standards. Any representation to the contrary is a criminal offense.